I. Executive Summary: Navigating the Convergence of Disruption and Digitalization

1.1 CNC Market Performance and Strategic Context (Q4 2025 Overview)

In the fourth quarter of 2025, the Computer Numerical Control (CNC) machining industry exhibited a distinctive dual characteristic: solid underlying growth coupled with intense external cost pressures. This environment has compelled manufacturers to pursue rapid technological adoption as a matter of survival and competitive differentiation.

From a market size perspective, the global CNC machine tool market is projected to reach approximately USD 109.46 billion in 2025¹. The U.S. market is estimated at USD 16.48 billion in 2025 and is expected to grow at a robust compound annual growth rate (CAGR) of 5.05% through 2035². The core driver behind this expansion is the surging demand for ultra-precision manufacturing. High-value industries such as aerospace, medical devices, electric vehicle (EV) powertrains, and semiconductor equipment are imposing increasingly stringent requirements on component quality, necessitating extremely tight tolerances and specifications². CNC machine tools, with their superior precision and repeatability, have become indispensable for meeting these demands².

From a competitive landscape perspective, the market is undergoing a fundamental structural shift. Competition is moving away from pure price-based rivalry toward innovation capability and supply-chain reliability². Manufacturers can no longer compete solely on cost; instead, differentiation increasingly depends on **digitalization, sustainability initiatives, and the integration of artificial intelligence (AI)**².

In the current environment, automation and AI optimization—traditionally viewed as growth accelerators—have evolved into critical mechanisms for operational cost defense. While market demand and capacity utilization remain elevated², external costs such as tariffs and raw material prices have risen sharply (see Section III). Automation and AI technologies mitigate labor cost pressures and material price volatility by enabling 24/7 operations and optimizing tool utilization. Their primary role has shifted toward protecting increasingly compressed profit margins amid unpredictable global economic headwinds.

At the same time, the market is rapidly segmenting based on manufacturers’ technological capabilities. High-CAGR sectors such as aerospace and semiconductors explicitly require tighter tolerances and multi-axis machining capabilities³—requirements that conventional three-axis machining centers can no longer satisfy⁴. Consequently, machine shops that fail to invest in five-axis capabilities and deep digital integration are being relegated to lower-margin, lower-complexity work. In contrast, innovation-driven, high-technology manufacturing partners are positioned to capture resilient, high-margin growth segments².

Table 1: Key CNC Technology Trends in Q4 2025

| Trend Domain | Q4 2025 Focus Areas | Key Drivers |

|---|---|---|

| Artificial Intelligence & Software | AI-assisted closed-loop CAM programming (NobleTek / Lambda Function); widespread adoption of Predictive Maintenance (PdM) | Reduced programming time and setup errors; pursuit of zero unplanned downtime |

| Hardware & Geometry | Accelerated adoption of 5-axis and multi-axis machining; launch of new 5-axis VMCs (e.g., YCM RX65+); hybrid manufacturing integration | Complex geometries in aerospace and medical sectors; improved precision and thermal stability |

| Operations & Automation | Robots and automation systems becoming standard; “lights-out” manufacturing and 24/7 unattended production | Cost structure optimization; labor shortage mitigation; capacity expansion |

| Sostenibilidad | Focus on energy efficiency optimization and waste management; energy consumption as a critical operating cost factor | Rising energy costs and “green” supply-chain requirements |

1.2 High-Impact Summary: Five Key Trends and Strategic Priorities for Q1 2026

1.2.1 Core Trend: AI-Enabled Closed-Loop Optimization

AI and machine learning have become deeply embedded in CNC machining workflows, evolving from passive monitoring tools into core elements of programming and process control. A notable example is the strategic partnership announced in Q4 2025 between NobleTek and Lambda Function AI⁵, which focuses on accelerating aerospace and defense manufacturing through AI-assisted CAM programming. The objective is to reduce air cutting, extend tool life, and improve first-pass yield⁶.

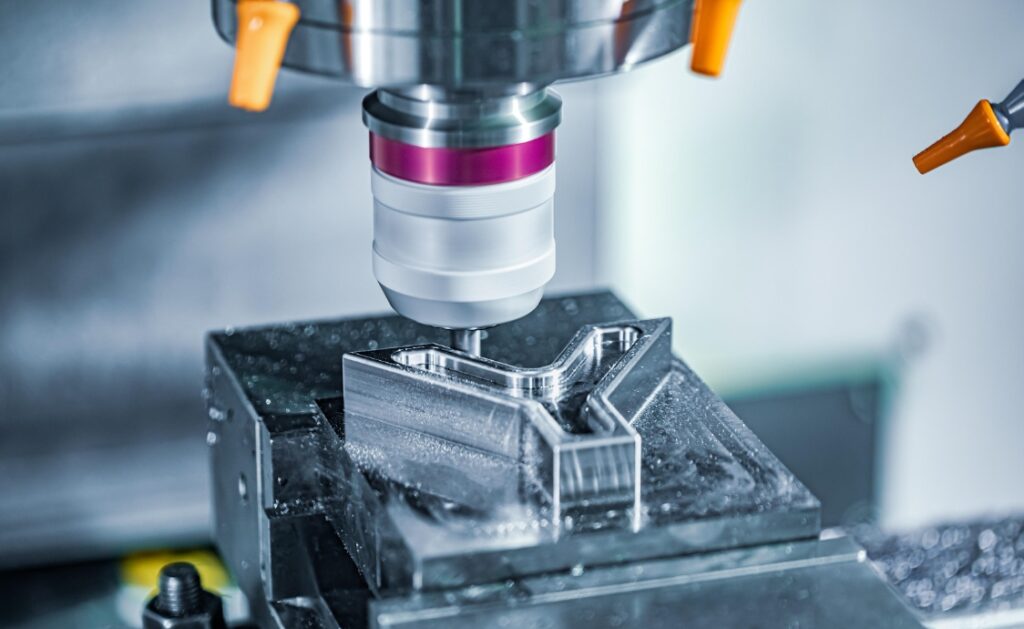

1.2.2 Hardware Evolution: Five-Axis Technology and Thermal Stability

Traditional three-axis machining is rapidly being displaced by five-axis and multi-axis technologies⁴. Hardware innovation is increasingly centered on maintaining stability and precision at high spindle speeds. The YCM RX65+ high-performance five-axis vertical machining center (VMC) launched in Q4 2025 emphasizes an 18,000 RPM spindle equipped with thermal sensors and a high-precision control system to ensure micron-level accuracy during extended operating cycles⁷.

1.2.3 Operating Models: Automation and Flexible Low-Volume Production

Automation has become a standard configuration for boosting throughput and reducing costs, enabling 24/7 unattended production⁹. Importantly, automation is no longer limited to high-volume manufacturing; it is increasingly deployed to support low-volume, high-mix production, aligning with emerging On-Demand Manufacturing models⁹.

1.2.4 Economic Pressures: Supply-Chain Volatility and Cost Defense

Global supply-chain costs are projected to exceed inflation by as much as **7%**¹¹. Tariffs have emerged as a core risk factor, impacting 82% of supply-chain activities and driving significant increases in raw material and energy costs¹². Manufacturers must build technology-driven supply-chain resilience to operate effectively in an environment where volatility has become the default state¹¹.

1.2.5 Talent Strategy: From Operators to Computational Engineers

Labor shortages and skills gaps persist¹⁴. Demand is surging for CNC programmers and maintenance technicians capable of managing complex automation systems, interpreting data, and applying computational modeling and simulation tools¹⁵. Modern training initiatives emphasize physics-based machining models, transforming traditional machinists into applied computational engineers who can optimize processes in digital twin environments before physical cutting begins¹⁶.

II. Hyper-Automated Shops: AI, Robotics, and Advanced Geometry

2.1 AI-Driven Precision and Closed-Loop Optimization

The deep integration of AI and machine learning represents the most transformative trend of Q4 2025. AI’s role has expanded from auxiliary monitoring to determinative influence over programming and process control.

2.1.1 AI Applications in Programming Efficiency

In Q4 2025, key strategic alliances emerged to operationalize AI in CNC programming. In December 2025, NobleTek and Lambda Function AI announced a partnership aimed at delivering AI-assisted CNC programming solutions for North American aerospace, defense, and adjacent manufacturers⁵. The Lambda Function software operates as an AI co-processor embedded within existing CAM platforms, recommending machining strategies, tools, toolpaths, and cutting parameters based on geometry and material characteristics⁶.

Its core value lies in a closed-loop learning system that continuously improves based on shop-floor feedback⁶, ensuring alignment between theoretical optimization and real-world production outcomes. Implementations have demonstrated benefits such as reduced air cutting, shortened setup-to-run times, extended tool life through data-driven feeds and speeds, and improved first-pass yield⁵.

More broadly, AI directly addresses persistent challenges related to workforce shortages and knowledge transfer. Given the industry’s reliance on veteran expertise amid ongoing skills gaps¹⁴, AI platforms like Lambda Function aim to capture and standardize best practices across programmers⁵. This effectively institutionalizes tacit knowledge, transforming scarce “tribal intuition” into repeatable algorithms, enabling less experienced operators to achieve consistent, expert-level results.

2.1.2 Advances in Intelligent CAM Software

Major CAD/CAM providers released AI-focused updates in Q4 2025. Hexagon MI’s ESPRIT EDGE introduced AI tools such as Hexagon Copilot and ProPlanAI, enhancing toolpath optimization and accelerating time-to-market¹⁷. Open Mind’s hyperMILL 2025 added automated five-axis tool orientation, significantly reducing manual input for complex part programming through pre-analysis of entire toolpaths¹⁷.

2.1.3 Maturation of Predictive Maintenance (PdM)

The industry is rapidly transitioning from reactive or time-based maintenance toward AI-driven predictive maintenance strategies¹⁸. By deploying IoT sensors on critical components such as spindles and motors, manufacturers enable continuous monitoring¹⁹. Machine learning algorithms analyze real-time data streams—such as vibration and temperature patterns—to learn normal operating states and predict failures well before they cause downtime¹⁹.

This enables CNC machines to function as self-diagnosing assets, triggering proactive interventions like automated maintenance work orders¹⁹. Achieving near-zero downtime is particularly critical given extended lead times for replacement components in today’s supply-chain environment¹⁸. However, this model also exposes a key limitation: the primary bottleneck is not algorithms, but IIoT infrastructure. Effective closed-loop AI requires large volumes of clean, structured data¹⁹. Tools like Fabrico are emerging as “operational brains” for smart factories by linking machine signals with maintenance teams to improve overall equipment effectiveness (OEE)²⁰.

2.2 Standardization of Robotics and Automation

Robotics and automation have become standard components of CNC operations, streamlining repetitive tasks such as material handling and inspection¹⁰. This shift enables factories to maximize capacity through unattended night and weekend shifts⁹. Automation systems aim for continuous 24/7 operation, improving throughput and reducing human error while maintaining consistent quality in large-scale production¹⁰.

Although automation requires significant capital investment and skilled personnel¹²¹, companies like FANUC are advancing collaborative automation solutions (cobots) that can safely operate alongside human workers, simplifying integration²². Importantly, automation is no longer exclusive to high-volume manufacturing. DMG MORI highlights a growing trend toward deploying automation for high-mix, low-volume production, a critical enabler of on-demand manufacturing models⁹.

2.3 Multi-Axis Technology and Hybrid Manufacturing

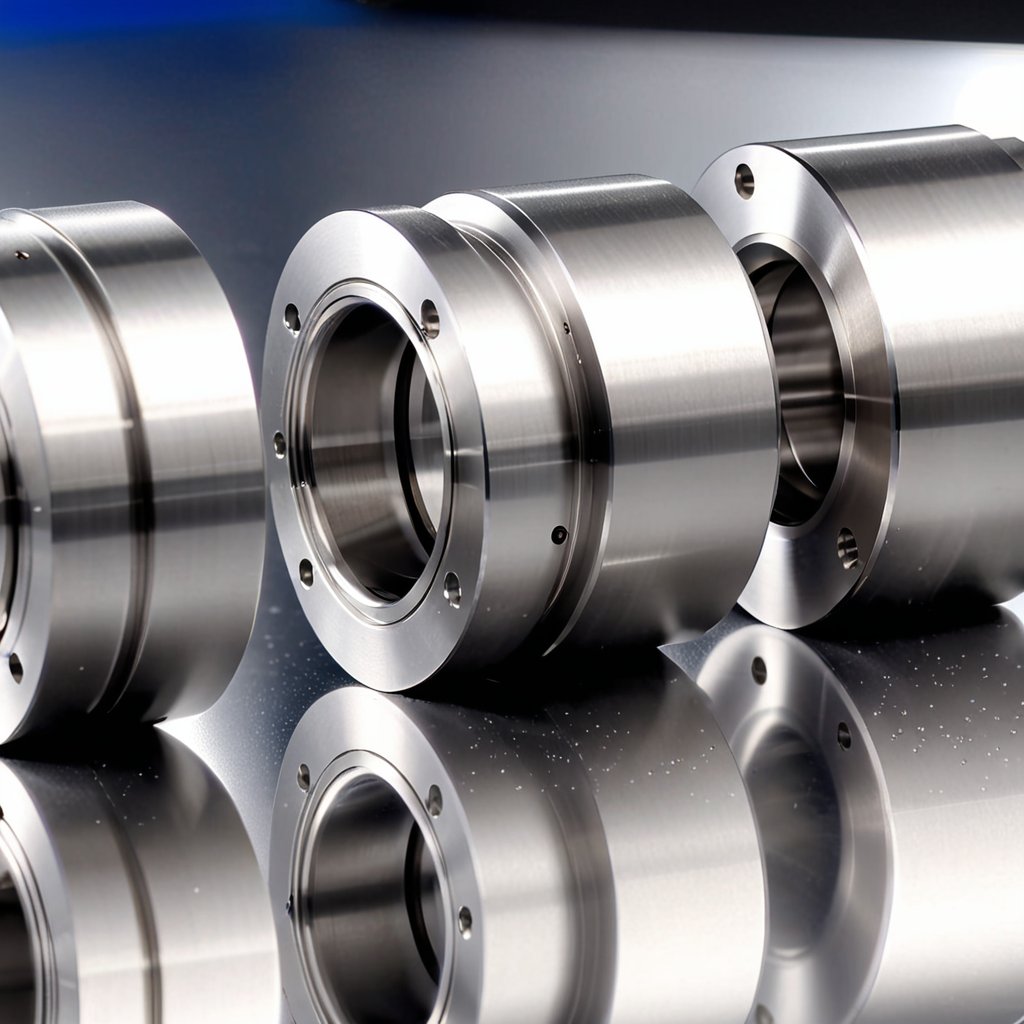

2.3.1 The Dominance of Five-Axis Machining

In aerospace, medical, and semiconductor markets, rising demand for complex geometries and advanced materials is accelerating the displacement of three-axis machining by five-axis and multi-axis systems⁴. Five-axis machining centers, capable of simultaneous motion across five axes, are ideally suited for producing high-complexity, high-performance components²³. For example, in drone manufacturing, five-axis machining enables precise contouring of complex surfaces, maintaining tolerances within ±0.01 mm, which is critical for aerodynamic performance²⁴.

2.3.2 Q4 Hardware Innovation and Thermal Stability

Hardware innovation in Q4 2025 focused on performance, rigidity, and control in multi-axis centers. YCM Alliance’s RX65+ five-axis VMC exemplifies this trend⁷, featuring an 18,000 RPM HSK63A GMN spindle with integrated thermal sensors and a Heidenhain iTN7 control system, widely regarded as one of the most trusted platforms in advanced manufacturing⁸.

The emphasis on thermal sensing and stability reflects a key evolution in precision manufacturing. High-speed machining generates significant heat, leading to thermal expansion and accuracy degradation. As a result, precision is no longer defined solely by mechanical rigidity but by thermal stability. For manufacturers evaluating new equipment, active thermal management systems are now essential, particularly for maintaining micron-level tolerances during prolonged 24/7 automated operation.

2.3.3 Integration of Hybrid Manufacturing

Hybrid manufacturing—combining subtractive CNC processes with additive manufacturing (AM/3D printing)—is gaining traction⁴. This approach accelerates prototyping, reduces material waste, and enables the creation of complex internal structures via AM, followed by CNC finishing for high-tolerance external surfaces. The result is a dual advantage of efficiency and geometric complexity⁴.

III. Economic Headwinds and Supply-Chain Resilience

3.1 Cost Escalation in a Global Context

In Q4 2025, global manufacturing cost pressures reached historic highs. According to Kearney, global supply-chain costs are expected to exceed inflation by up to **7%**¹¹. Volatility is no longer a disruption—it has become the default operating condition¹¹.

Tariffs have emerged as a central risk factor. Surveys indicate that 82% of supply chains have been affected by new tariffs, with 20–40% of supply-chain activities impacted¹². Operationally, 39% of respondents reported increased supplier and raw material costs, while 30% experienced reduced customer demand¹². Most firms have chosen not to pass the full tariff burden on to customers, intensifying internal margin pressure and forcing deeper operational optimization¹².

3.1.1 Raw Material and Energy Volatility

Structural cost challenges are compounded by raw material price volatility. Energy inflation has raised the cost of metal extraction and processing, while geopolitical uncertainty—such as shifting trade policies and regional conflicts—has disrupted stable access to metals and minerals¹³. Surging demand from high-growth sectors like EVs, aerospace, and renewable energy is further straining supplies of critical materials¹³. Surveys from the National Association of Manufacturers (NAM) confirm rising concern over trade uncertainty and raw material costs²⁶.

3.1.2 Strategic Responses and Resilience Building

Under conditions of persistent volatility, traditional Just-in-Time (JIT) efficiency models are proving inadequate. Industry guidance now emphasizes adaptability as a core principle of supply-chain design, prioritizing scenario planning and technology-enabled, multi-node networks that can rapidly adjust during disruptions¹¹. This shift reflects a new manufacturing philosophy centered on “Just-in-Case” resilience, rather than pure efficiency.

Manufacturers must strategically build redundancy through multi-source procurement and invest in digital tools that allow rapid switching between materials or suppliers without jeopardizing delivery schedules. In this context, automated quoting systems have emerged as a major trend¹⁰. In markets where material and energy costs fluctuate weekly, manual static quoting introduces significant financial risk. AI-driven quoting tools can dynamically adjust pricing based on material volatility and machine load, protecting margins amid uncertainty.

3.2 Strategic Sourcing and On-Demand Manufacturing

As competition shifts from price toward innovation and reliability², manufacturers capable of sourcing advanced materials quickly and reliably gain increased market leverage. The rise of on-demand manufacturing platforms is a direct response to supply-chain volatility, providing flexibility and agility for prototyping and gap-filling production¹⁰.

IV. Sustainability, Efficiency, and New Operational Mandates

4.1 Adoption of Green Manufacturing and Energy Savings

In Q4 2025, sustainability commitments in the CNC industry are driven by both regulatory pressure and rising energy costs.

4.1.1 Energy Efficiency as a Cost-Control Tool

As energy prices rise and climate targets become more ambitious, improving energy efficiency in CNC manufacturing has become critical²⁷. Manufacturers must make production processes more sustainable without compromising economic viability²⁷. As a result, energy efficiency has emerged as a competitive advantage in energy-intensive manufacturing sectors²⁸.

Modern CNC machines reduce energy consumption through innovations such as intelligent energy management systems that significantly lower idle energy use²⁷, energy-efficient servo motors and regenerative braking systems capable of reducing energy consumption by up to **30%**²⁷, and smart algorithms that optimize acceleration curves and travel paths to deliver spindle power and coolant flow on demand²⁷.

4.1.2 Waste and Resource Management

Manufacturers are increasingly adopting greener practices, including fluidos de corte biodegradables, higher recycling rates, and advanced management systems to prevent contamination and minimize hazardous waste²⁹. By optimizing material utilization and reducing waste generation, companies can achieve cost savings in both raw material procurement and waste disposal, improving overall operational efficiency³¹.

Notably, sustainability has evolved from a compliance issue into a supply-chain requirement. Major automotive OEMs such as Magna have launched large-scale sustainability initiatives (e.g., ECO50) with explicit targets to expand renewable energy usage by the end of 2025³². This pressure cascades downstream to CNC suppliers, meaning those unable to demonstrate compliance in energy efficiency and waste reduction risk exclusion from major contracts.

4.2 Machining of Advanced Materials

4.2.1 Demand for High-Challenge Materials

Key sectors such as aerospace, medical, and renewable energy are driving demand for complex, lightweight components made from composites, ceramics, and specialty alloys³. CNC machining remains critical for the energy sector, including the production of wind turbine components and high-temperature, high-pressure turbine blades for conventional power generation²⁸.

4.2.2 Operational Challenges and Technical Countermeasures

Machining composites introduces specific challenges, including extreme tool wear due to abrasiveness, delamination risks, and difficulty maintaining dimensional accuracy due to material anisotropy³⁴. Successfully machining these materials requires integrated hardware and software solutions, including advanced tooling, optimized cutting parameters, improved cooling and lubrication strategies³⁴, and high-rigidity, thermally stable hardware such as five-axis centers with thermal sensors⁸.

Intelligent software must also monitor tool wear in real time and dynamically optimize toolpath strategies¹⁹ to prevent catastrophic failures and extend the life of expensive tooling.

V. Workforce Transformation and Talent Strategy

The Q4 2025 industry environment demands a fundamentally new skill set, emphasizing digital literacy and simulation-based modeling, rather than purely mechanical expertise.

5.1 Addressing the Digital Skills Gap

CNC talent demand is shifting toward higher-technology roles. High-demand positions include technicians skilled in maintaining automation systems, CNC machines, and robotics, as well as professionals with advanced CNC programming and operational expertise for precision manufacturing¹⁵. New skill requirements emphasize data literacy, the ability to interpret real-time IoT machine data, and expertise in simulation and modeling to reduce costly trial-and-error¹⁶.

Investment in continuous CNC training has become a strategic imperative, directly improving productivity and safeguarding competitive advantage³⁵. The relatively high median annual wage for CNC programmers (USD 63,440 as of May 2024) underscores the market’s valuation of advanced expertise³⁵.

5.1.1 From G-Code to Physics-Based Modeling

New training initiatives emphasize physics-based, material-specific machining models and the application of computational simulation for process optimization¹⁶. The Machining AdvantEdge program, actively advancing through Q4 2025, aims to equip participants with modeling tools that guide better decision-making from design through production¹⁶.

This shift indicates that modern CNC machinists and programmers are evolving into applied computational engineers. Their value increasingly lies in optimizing processes within digital twin environments before metal is cut, minimizing waste, reducing setup times, and mitigating the risks associated with high-cost materials and complex five-axis motion.

5.2 Review of Recent Training Programs (Q4 Focus)

Collaborations between industry and academia are actively addressing the skills gap. The Machining AdvantEdge program—developed by the University of St. Thomas, the Air Force Research Laboratory (AFRL), and Third Wave Systems—offers free training focused on optimizing CNC machining through computational simulation¹⁶. This initiative reflects widespread recognition of digital tools’ critical role in reducing waste and improving output.

Education systems are also adapting through formalized apprenticeship pathways covering modern roles such as Computer-Aided Manufacturing Technicians and CNC Machinists, ensuring curriculum relevance to industry needs and creating clear pathways to employment³⁶.

VI. Conclusion and Forward Roadmap (Q1 2026)

Analysis of Q4 2025 confirms that the CNC industry is simultaneously facing unprecedented technological opportunity (AI, five-axis machining, IoT) and economic adversity (cost volatility, tariffs). Success in Q1 2026 will depend entirely on how rapidly executives deploy technology—not only to drive growth, but as a core mechanism for cost defense and risk mitigation.

6.1 Synthesis of Key Conclusions

-

AI transformation has entered core operations: AI is no longer auxiliary; through closed-loop CAM programming and predictive maintenance, it has become central to productivity and margin protection by institutionalizing scarce expert knowledge.

-

Precision standards are shifting from rigidity to thermal stability: Competitive differentiation in high-precision manufacturing now hinges on real-time control of thermal expansion and vibration, as reflected in next-generation five-axis equipment designs such as the YCM RX65+.

-

Resilience is superseding efficiency: In an era of geopolitical and tariff-driven cost volatility, traditional lean (JIT) models must give way to Just-in-Case supply-chain resilience, supported by digital tools and multi-node sourcing.

-

Sustainability is a contractual prerequisite: As upstream supply chains—especially in automotive and aerospace—push green mandates, CNC manufacturers unable to demonstrate energy efficiency and waste management capabilities risk market exclusion.

-

Talent structures require fundamental realignment: The industry urgently needs professionals with data modeling and simulation expertise to fully leverage advanced hardware and AI software, enabling pre-optimization in digital twin environments.

6.2 Strategic Roadmap for Q1 2026

Based on Q4 2025 trends, manufacturers should prioritize the following actions in Q1 2026:

-

Mandate AI operationalization (programming and PdM): Scale AI-assisted CAM programming and predictive maintenance from pilot projects to standardized, shop-wide deployment. Prioritize investment in IIoT infrastructure—sensors and data gateways—to ensure high-quality, standardized data streams that support continuous closed-loop learning.

-

Invest in thermal stability and five-axis capability: Direct capital expenditures toward multi-axis machines with advanced thermal stability systems and high-end controls (e.g., Heidenhain iTN7) to meet the stringent precision demands of high-margin aerospace and medical projects. Incorporate thermal stability metrics into equipment evaluation criteria to maintain micron-level tolerances during 24/7 automated operation.

-

Build digital commercial resilience: Deploy AI-driven automated quoting systems capable of responding in real time to raw material and energy cost fluctuations, safeguarding margins amid persistent volatility. Invest in multi-node, technology-enabled supply-chain networks supported by digital scenario planning to proactively manage tariff impacts and material shortages.

-

Reskill the workforce through simulation-focused training: Allocate training budgets toward internal and external programs emphasizing computational simulation, data literacy, and robotic maintenance. The objective is to transform core machinists into applied computational experts whose value is realized before cutting begins—through modeled optimization that unlocks the full OEE potential of advanced manufacturing assets.