I. Executive Summary: Navigating the 2025 CNC Industry Landscape and Strategic Imperatives

The global Computer Numerical Control (CNC) machine tool industry is poised for robust and accelerating growth in 2025. This expansion is primarily driven by the increasing adoption of automation in manufacturing, the stringent demand for precision machining, and the deepening integration of transformative technologies such as Artificial Intelligence (AI), multi-axis machining, and the Internet of Things (IoT). Key sectors like automotive (especially new energy vehicles), aerospace, and medical devices will continue to be major engines of market demand.

Dominant industry trends include the deepening integration of Industry 4.0 concepts, the rise of smart factories, a growing focus on sustainable and energy-efficient solutions, and the emergence of hybrid manufacturing models. Consequently, corporate strategic priorities will revolve around technology adoption, specialization in high-growth segments, development of value-added services, workforce upskilling, and enhancing supply chain resilience.

Notably, the diverse growth drivers—rising automation demand, higher precision standards, strong pull from specific industries, and rapid technological advancements—are not isolated but interconnected, creating a synergistic effect. This means the market is not just expanding in size but also undergoing a profound paradigm shift. Incremental improvements may be insufficient; companies need to consider more fundamental strategic adjustments. For instance, the extreme precision requirements in aerospace directly propel the development and application of multi-axis machining and AI-driven optimization algorithms. This interplay and mutual reinforcement of multiple drivers generate growth momentum far exceeding the simple sum of individual factors. Therefore, companies focusing solely on a single dimension (like cost control or specific machine types) risk missing the industry-wide transformation wave. A comprehensive and holistic strategy is essential for sustained success.

II. Global CNC Market Dynamics in 2025: Growth, Drivers, and Forecasts

A. Overall Market Size and Growth Projections

The CNC machine tool market is projected to experience growth ranging from steady to robust. Research and Markets forecasts the global CNC machine tool market size to increase from $28.11 billion in 2024 to $29.5 billion in 2025, representing a Compound Annual Growth Rate (CAGR) of 4.9%, and anticipates it reaching $36.33 billion by 2029, with the CAGR accelerating to 5.3%. Technavio estimates the market will grow by $21.9 billion between 2025 and 2029, at a CAGR of 5.4%. Fortune Business Insights offers a more aggressive forecast, valuing the global CNC machine market at $95.29 billion in 2024, projecting growth to $101.22 billion in 2025, and reaching $195.59 billion by 2032, reflecting a high CAGR of 9.9%. Valuates Reports indicates the global CNC machine tool market (potentially including a broader definition like blades) was $82.03 billion in 2021 and projects it to reach $126.8 billion by 2028, with a CAGR of 6.42%. Maximize Market Research assesses the broader machine tool market (including CNC) at $140.55 billion in 2024, forecasting a 6% CAGR from 2025 to 2032, reaching $224.02 billion. Exactitude Consultancy predicts the CNC machine market at $77 billion in 2024, exceeding $123 billion by 2034, with a CAGR of 5.5%. The Insight Partners estimates the market size will grow from $82.5 billion in 2024 to $122.4 billion by 2031, at a CAGR of 5.8%. Coherent Market Insights estimates the CNC machine market value at $88.13 billion in 2025, reaching $168.49 billion by 2032, with a CAGR of 9.7%.

While these figures vary due to differences in statistical scope and market definitions—for example, some reports might focus solely on CNC machine tools themselves , while others may encompass broader systems including software, services, and more machine types (e.g., explicitly mentions the “CNC Machine Tool Blade Market” as a sub-segment, implying broader coverage in its main report)—they collectively depict a continuously growing and sizable global market. All sources point towards CAGRs ranging from 5% to 10%, revealing strong intrinsic growth momentum and widespread adoption. This positive growth trajectory is a crucial basis for corporate investment and strategic planning, with the accelerating CAGR trend in some forecasts suggesting strengthening market drivers.

Analyzing deeper, even reports with slightly earlier base years (like using 2021) projecting continued growth indicate the strong resilience of the CNC market. Between 2021 and 2025, the global economy faced numerous uncertainties, including supply chain issues. Yet, the CNC market maintained strong growth expectations, demonstrating that the demand for its core offerings (automation and precision machining) is robust enough to withstand macroeconomic headwinds. This resilience makes the CNC industry a relatively stable long-term investment area, where strategic investments are less susceptible to short-term economic fluctuations.

B. Key Market Drivers

-

Sustained High Demand for Automation and Precision Machining: The manufacturing sector’s shift towards automation to enhance efficiency, reduce human error, and ensure consistency is the primary driver for CNC market growth. CNC machines are crucial for optimizing manufacturing processes. Industries like aerospace, automotive, medical, and electronics increasingly demand high-precision components with tight tolerances , which are vital for product quality, performance, and safety. The need for mass production and mass customization also fuels CNC technology adoption. This fundamental demand for automation and precision forms the bedrock of the entire CNC market’s growth. Companies offering higher precision and more automated solutions will hold a significant competitive advantage.

-

Widespread Adoption of Industry 4.0 and Smart Manufacturing: Industry 4.0 is profoundly transforming manufacturing through enhanced automation, digitalization, increased efficiency, real-time data analytics, IoT, and AI applications. Smart machines can predict maintenance needs, reduce downtime, and optimize operations. Cloud platforms and digital twin technologies facilitate real-time monitoring and optimization. Smart factories equipped with interconnected CNC machines have become a key trend. Industry 4.0 integrates CNC machines into the smart factory ecosystem, enhancing their capabilities through IoT integration, real-time data monitoring, predictive maintenance, and AI-driven automation. This involves not just individual machine performance but integrating them into a larger, intelligent manufacturing ecosystem, opening new avenues for software, connectivity solutions, and data analytics services.

-

Expansion of Core End-User Industries:

- Automotive Industry: The thriving automotive sector, including the production of New Energy Vehicles (EVs), drives demand for CNC machines for processing engine parts, chassis, transmission systems, and complex lightweight components. The automotive industry accounts for a significant share of machine tool consumption.

- Aerospace & Defense: This sector requires high-precision machining for complex components, lightweight high-strength alloys, aircraft parts, assemblies, and tooling, benefiting from increased defense budgets.

- Electronics Industry: Growing demand for miniaturized and precision-machined devices.

- Medical Devices: Increasing need for precision machining for surgical instruments, implants, and diagnostic equipment.

- Energy & Power: CNC machines are used to manufacture components for wind turbines, oil & gas, and other energy applications. Understanding the specific needs and growth trajectories of these key industries helps CNC suppliers tailor their products and services and formulate more precise market strategies.

- Automotive Industry: The thriving automotive sector, including the production of New Energy Vehicles (EVs), drives demand for CNC machines for processing engine parts, chassis, transmission systems, and complex lightweight components. The automotive industry accounts for a significant share of machine tool consumption.

The combined effect of these drivers indicates that the market is growing not just in volume but also in complexity. Demand is shifting from “more CNC machines” to “smarter, more precise, and highly integrated CNC solutions” to meet the increasingly complex applications in high-stakes industries. For example, automation and high precision are fundamental requirements; Industry 4.0 adds layers of intelligence and connectivity; and specific sectors like aerospace and medical impose extremely high standards for accuracy and material complexity. This convergence means a simple standalone CNC machine is far less valuable than one integrated into a smart factory , capable of handling advanced materials , and delivering verifiable precision enabled by AI and IoT. This undoubtedly raises the competitive bar but also creates opportunities for companies providing such advanced, holistic solutions.

Furthermore, the strong demand from diverse end-user industries, each with unique requirements (e.g., complex geometries in aerospace , biocompatible materials in medical ), creates fertile ground for niche specialization within the CNC market. A “one-size-fits-all” approach is becoming less viable, pushing CNC manufacturers and service providers to develop deep expertise in specific verticals. For instance, automotive requires high-volume production of robust parts , aerospace needs high-precision parts with complex geometries and advanced materials , medical demands precision parts with special (often biocompatible) materials and miniaturization , and electronics pursues miniaturization and high-precision mass production. These varied needs mean a CNC machine optimized for automotive engine blocks might be unsuitable for delicate medical implants. Consequently, CNC companies that can offer deep understanding and tailored solutions for specific industry pain points (e.g., a 5-axis machine pre-configured for turbine blade optimization, or a micro-milling machine designed for medical stents) are more likely to command premiums and build stronger customer loyalty, helping resist market commoditization.

III. Key Technological Advancements Driving the Future of CNC

-

Artificial Intelligence (AI) and Machine Learning (ML): Revolutionizing Efficiency and Predictive Capabilities AI is a major driver of market evolution. AI algorithms can optimize toolpaths, predict maintenance needs (reducing downtime by identifying part replacement needs before failure), monitor quality in real-time, and adapt to changing conditions, thereby enhancing precision and reducing errors. AI can also analyze historical data to improve future machining processes and resource allocation, and even automatically generate CNC code. AI assistants in CAM software help less experienced workers handle more complex tasks. In smart factories, AI-powered quality checks and robotic integration minimize the need for human labor. AI is shifting CNC from programmed automation towards intelligent, adaptive automation, making it a critical area for R&D and product development.

-

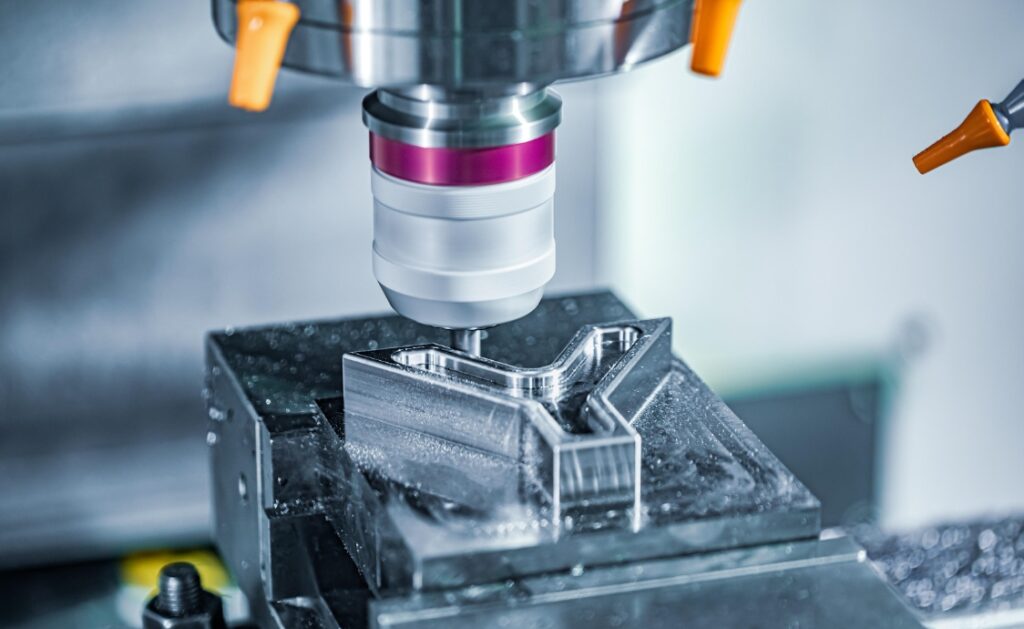

Multi-Axis Machining (Especially 5-Axis and Beyond): Enabling Complexity and High Precision Demand for high-precision, multi-axis machining centers is rising. Five-axis, and even six- or seven-axis machines, can process parts with complex geometries, curves, and angles in a single setup, improving accuracy and efficiency. This is crucial for aerospace, medical implants, and other advanced manufacturing sectors. The use of multi-axis milling machines has grown by about 30% in recent years. China’s 5-axis machine tool market also shows strong growth, with vertical machining centers dominating this sub-segment. Multi-axis capability is becoming standard for high-value manufacturing, allowing for more intricate designs and significantly reducing setup times.

-

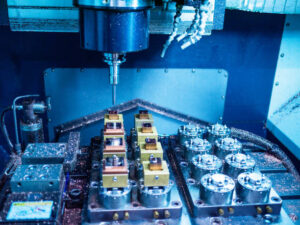

Automation and Robotic Integration: Towards Unmanned Operation Automation and robotics are indispensable for streamlining repetitive tasks like material handling, inspection, and tool changing, enabling 24/7 operation. This not only increases production capacity and minimizes human error but also ensures consistent product quality and optimizes costs. Smart CNC factories employ AI quality checks and robotic arms. Full automation is the industry direction, reducing labor dependency, maximizing machine utilization, and critically addressing labor shortages.

-

Internet of Things (IoT), Connectivity, and Real-Time Data Analytics IoT sensors enable real-time monitoring of machine performance, tool wear, part quality, and temperature, supporting predictive maintenance. Cloud computing allows remote data access, monitoring, diagnostics, and control, enhancing flexibility and Overall Equipment Effectiveness (OEE). Digital twin technology permits virtual simulation of machining processes, reducing setup times and errors. Data is becoming as valuable as the machined part itself. Connectivity enables smarter operations, proactive maintenance, and informed decision-making.

-

Hybrid Manufacturing (Additive and Subtractive) Combining CNC machining (subtractive) with additive manufacturing (3D printing) offers superior design potential, better material utilization, higher speed, and flexibility. This enables the creation of complex geometries previously impossible to manufacture, accelerates prototyping, and reduces material waste. Okuma’s Laser EX series machines exemplify this. This convergence creates highly versatile machines capable of supporting entirely new manufacturing workflows

-

Advanced Material Processing There is growing demand for machining lightweight yet durable materials like advanced composites, high-temperature alloys (e.g., titanium, Inconel), and modified polymers. This requires CNC machines equipped with enhanced tooling, cooling technologies, and higher precision. The use of materials like Polycrystalline Diamond (PCD) and solid carbide in CNC machine tooling has significantly increased. Advances in material science necessitate parallel advancements in machining capabilities; mastering the processing of these new materials can be a significant differentiator.

-

Sustainability and Energy-Efficient Solutions Environmental practices are gaining importance: including material recycling, waste reduction through advanced nesting algorithms, improving machine energy efficiency, and using biodegradable cutting fluids. Over 20% of new CNC milling machine models focus on reducing energy consumption. Energy efficiency regulations also drive the adoption of energy-saving solutions. Sustainability is becoming a regulatory and market imperative, influencing machine design and operational practices

-

Improved Software and Simulation Capabilities Advanced CAD/CAM software provides precise modeling and simulation features, optimizing designs, predicting potential issues, streamlining the design-to-production workflow, and reducing costly errors before production begins. User-friendly interfaces simplify operation and programming. Software is key to unlocking the full potential of CNC hardware, making complex operations more accessible and reliable

These technological advancements are not isolated but increasingly interconnected. For instance, AI is crucial for optimizing multi-axis toolpaths , managing robotic automation , analyzing IoT data for predictive maintenance , and enabling hybrid manufacturing processes. This interconnectedness means future CNC systems will be highly integrated “intelligent systems” rather than just standalone machines. AI optimizes toolpaths , which is particularly complex for multi-axis machines ; robotic integration benefits from AI for smarter task execution and quality control; IoT generates vast data , which AI/ML algorithms process for insights like predictive maintenance; hybrid manufacturing involves coordinating additive and subtractive processes, well-suited for AI-driven control and optimization. This interdependence suggests companies cannot simply cherry-pick technologies; a systems-level approach to adoption and development will be more effective, where the value lies in the synergy.

The rapid development and convergence of these technologies could accelerate the obsolescence cycle for older CNC equipment and create a “technology adoption gap” between early adopters and laggards. This might lead to market consolidation, as technologically advanced firms gain significant competitive advantages in efficiency, capability, and cost. The pace of innovation is high (AI, multi-axis, IoT, hybrid AM developing rapidly and concurrently), and these new technologies offer substantial benefits in efficiency, precision, and capability. Companies that invest in and successfully integrate these technologies will be able to produce more complex parts faster, with less waste, and at lower long-term costs (despite higher initial investment). This will put companies still relying on older, less capable CNC technology at a significant disadvantage. Equipment replacement cycles are mentioned as 5-10 years , and rapid technological progress might shorten the effective cycle for cutting-edge applications. This dynamic could make it difficult for laggards to compete, potentially leading to acquisitions by more advanced players or relegation to lower-margin, less complex work. This is a key strategic consideration for users.

IV. Market Segmentation: Identifying High-Potential Niche Markets

A. Analysis by Machine Tool Type

The CNC machine tool market primarily consists of lathes, milling machines, grinding machines, and cutting tools (like laser and plasma cutters).

- Cutting Machine Tools: Within the broader machine tool market, cutting machines generated $66 billion in revenue in 2024 and are projected to grow at a CAGR of approximately 8.1% between 2025 and 2034, driven by increasing demand for precision metal processing. The metal cutting tools market is expected to reach $41.64 billion by 2029, with a CAGR of 6.9%. Some reports indicate the metal cutting segment will hold the largest market share and achieve the highest CAGR.

- Metal Forming Machine Tools: One report projects the metal forming segment to experience the fastest growth due to increased demand for high-speed processing in areas like die stamping, forging, and pressing.

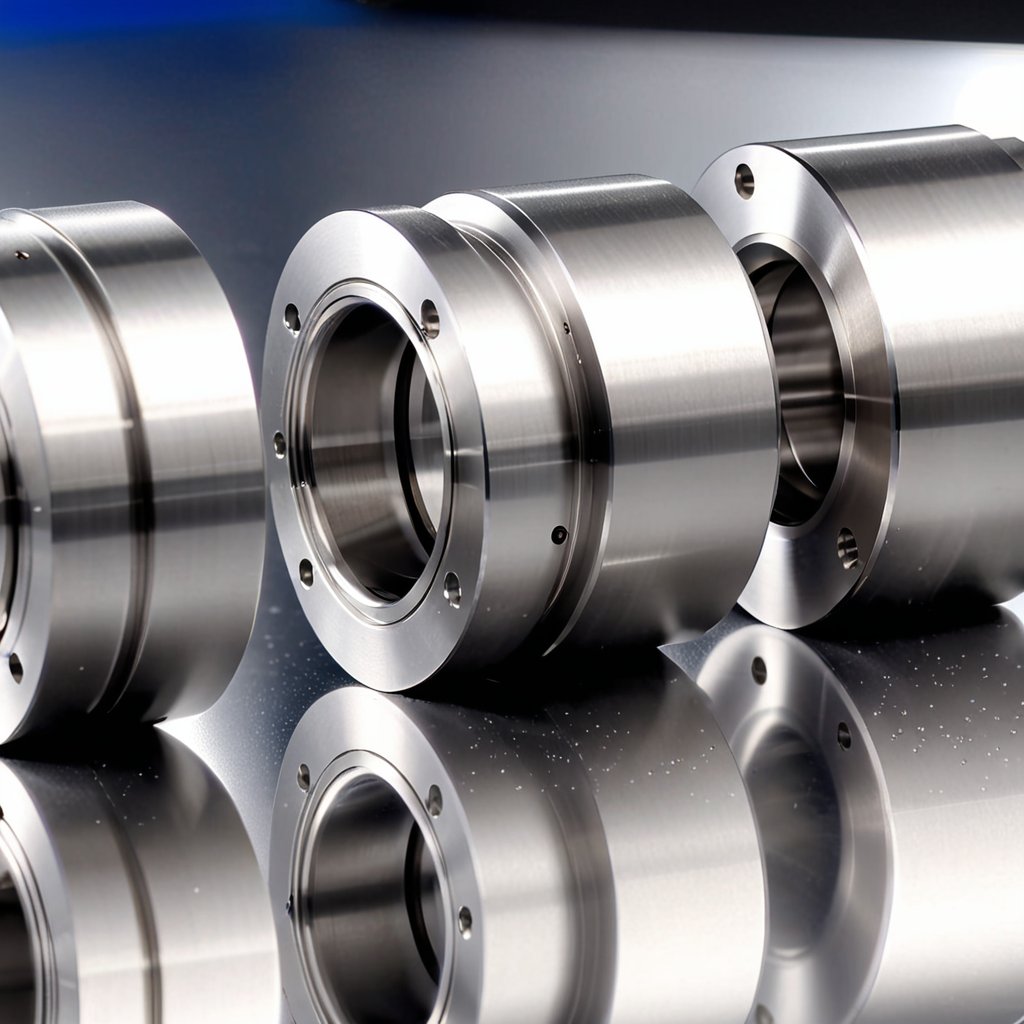

- CNC Lathes: Crucial for manufacturing precise and complex components in industries like automotive, aerospace, manufacturing, and medical, holding a significant position. Technological advancements include multi-axis control, real-time tooling, and automatic part loading. Lathes held the largest market share in Europe in 2023

- CNC Milling Machines: Milling machines offer versatile functions (e.g., boring, turning, drilling, gear cutting). The CNC milling machine market was valued at $15.67 billion in 2024, projected to reach $16.62 billion in 2025 and $26.7 billion by 2033, with a CAGR of 6.1%. Vertical CNC milling machines are expected to account for 46.3% of the market share by 2025. One report predicts milling machines will achieve the fastest CAGR in the European market.

- CNC Engravers/Routers: Entry-level models start from $5,000, while high-end models exceed $100,000. The North American CNC router market is projected to reach $144.4 million by 2030, with a CAGR of 5.2%. The desktop CNC engraver segment is expected to grow fastest due to IoT/AI integration.

- CNC Laser Cutting Machines: Prices range more widely, from $20,000 to over $200,000.

- Desktop CNC Machines: This market was valued at $2.4 billion in 2024 and is projected to reach $6 billion by 2037, with a CAGR of 9.5%

Understanding the growth rates and specific technological advancements for each machine type helps identify focus areas for product development or investment.

Table 1: Overview of CNC Machine Tool Types Market in 2025

| Machine Tool Type | Estimated Global Market Share/Size (2025) | Estimated CAGR (2025-2029/2032) | Key Technological Advancements/Trends | Primary Application Areas |

|---|---|---|---|---|

| CNC Lathes | Significant Market Component | 5.4% (Overall Market) | Multi-axis control, real-time tooling, automatic part loading | Automotive, Aerospace, Medical, General Manufacturing |

| CNC Milling Machines | Significant Market Component, Est. $16.62B in 2025 (Milling Market) | 6.1% (Milling Market) | Multi-axis adoption (30% growth) , AI/IoT integration | Automotive, Aerospace, Electronics, Precision Engineering |

| CNC Grinding Machines | One of the market segments | Grows with overall market | High precision, automation | Precision parts machining |

| CNC Laser Cutting Machines | One of the market segments | Grows with overall market | High power, high precision, diverse material processability | Sheet metal processing, non-metal cutting |

| CNC Engravers/Routers | North America market est. $112.5M in 2025 | 5.2% (NA Routers) | IoT/AI integration (Desktop) | Woodworking, signage, light metal processing |

| Hybrid Manufacturing Machines | Emerging growth area | High growth potential | Combination of additive & subtractive, complex geometry manufacturing | Prototyping, complex parts, small-batch customization |

| Desktop CNC Machines | Est. $2.5B in 2025 (Desktop Market) | 9.5% (Desktop Market) | Multi-functionality, ease of use, AI/IoT integration | SMEs, Education, Hobbyists |

Note: Market share/size and CAGR data are from various reports and may have scope differences. This table aims to provide a trend reference.

This table provides a quick comparative overview of the most promising machine types, helping users understand which types are growing fastest, where innovation is concentrated, and what applications they serve, directly informing strategic focus on specific machine types.

B. Analysis by End-User Application

- Automotive Industry: A major CNC consumption area with high precision requirements for engines, chassis, and NEV components, involving large production volumes. Expected to be the fastest-growing segment in Europe.

- Aerospace & Defense: Requires high precision, complex parts, and advanced material processing. Represents a significant growth opportunity.

- General Machinery/Industrial Manufacturing: Widely used for processing various components.

- Precision Engineering: One report projects this segment to grow at the highest CAGR, producing complex, high-quality components for advanced industries

- Medical Devices: Growing demand for precision instruments and implants.

- Electronics Industry: Miniaturization, high-volume precision parts processing.

- Metal Fabrication: In the broader machine tool market, held over 73.5% revenue share in 2024 and is projected to grow at 8% until 2034.

These segmentation data reveal a market trend towards “application-specific solutions.” While general-purpose CNC machines still have a market, high growth and high value often reside in machines and services optimized for the unique demands of specific industries. For example, aerospace requires complex geometry capabilities , automotive needs mass production capacity , and medical demands high precision and often specialized material capabilities. Reports highlight specific machine types or features being driven by particular industries, e.g., multi-axis machining driven heavily by aerospace and medical. The precision engineering segment stands out for its high CAGR , and it inherently serves industries with very specific and demanding requirements. This suggests that CNC suppliers who can offer deep expertise and tailored solutions for these specific applications (e.g., a machine pre-configured for dental implant manufacturing, or software optimized for turbine blade machining) will capture higher value than those offering generic machines.

Notably, the rise of “Desktop CNC Machines” , with its significant CAGR (9.5%) and market size ($2.5B est. 2025), indicates a trend towards the democratization of CNC technology. This opens up new market segments like SMEs, educational institutions, and hobbyists, potentially creating demand for different types of machines (more affordable, user-friendly) and support services (training, simplified software). This contrasts with the high-end, complex systems required by industries like aerospace or automotive. Drivers for desktop CNC growth include multi-functionality/hybrid capabilities and use in education. This suggests a potential market bifurcation: one track for high-end, highly specialized industrial solutions, and another for accessible, versatile, and affordable solutions for smaller businesses or new applications. This could imply new sales channels, different marketing strategies, and a need for user-friendly interfaces and training distinct from the traditional industrial CNC market, presenting opportunities for companies specializing in this emerging segment.

V. Regional Market Landscape: A Global Opportunity Scan

-

Asia-Pacific (APAC): Continued Dominance and the China Factor APAC dominated the global market with a 55.32% share in 2024 , while another report cites a 39% contribution. In the 2024 machine tool market, APAC held a 46.2% share, with revenue around $44.8 billion. The region’s growth is fueled by rapid industrialization, high manufacturing growth, and increasing automation in sectors like automotive, aerospace, electronics, and construction. Key countries include China, Japan, South Korea, and India. China: Is the world’s largest machine tool producer and consumer. Government initiatives like “Made in China 2025” and “Make in India” stimulate investment in advanced manufacturing technologies and smart factories. China’s CNC machine tool market reached RMB 409 billion in 2023, projected at RMB 432.5 billion in 2024; the 5-axis market is expected to exceed RMB 12 billion in 2024. The goal is to increase the domestic share of the high-end market from 6% to 10-15% by 2025. China emphasizes localization of core components (CNC systems, servo motors), though high-end systems still rely on imports (Fanuc, Siemens hold >60% share). Future trends in China include high-end development, localization breakthroughs, and deepening smart manufacturing. APAC, especially China, is not just a massive market but also a center of manufacturing transformation and a competitive arena with strong local and international players. Understanding its localization efforts is crucial

-

North America: Innovation and Advanced Technology Adoption The North American market is expected to grow significantly and play a vital role. The US CNC machine tool market is projected for substantial growth, reaching $150.3 billion by 2032. The region’s high adoption rate of advanced technologies and the presence of large corporations are key drivers. Strong R&D capabilities, reshoring initiatives, and government incentives for advanced manufacturing also boost the market. By 2037, North America’s desktop CNC market is expected to hold over 48.5% revenue share, driven by rapid prototyping and educational use. Increased investment in aerospace and defense (generating $425 billion economic value in the US in 2023) also lifts the CNC market. North America is a key market for high-tech CNC applications and innovation, particularly in aerospace, defense, and medical sectors.

-

Europe: Strong Industrial Base and Industry 4.0 Leadership The European market plays a significant role with a considerable CAGR. Germany, Italy, and the UK lead in aerospace and automotive applications. Germany, Italy, and Switzerland are key players due to strong engineering capabilities and high R&D investment. Market drivers include industrial automation, Industry 4.0 adoption (70% of EU manufacturing firms are integrating advanced tech like IoT & AI), and demand from automotive (approx. 30% of European machine tool consumption) and aerospace (EU produces >20% of global aerospace components). The European CNC machine tool market was valued at $22.23 billion in 2024, projected to reach $52.76 billion by 2033, with a CAGR of 10.08%. Another report indicates the market size will grow from $26.02 billion in 2023 to $57.63 billion by 2033, at a CAGR of 8.28%. The presence of global giants like DMG Mori, GF Machining Solutions, and Makino Europe ensures R&D investment. Europe is a mature market with high standards, strong Industry 4.0 implementation, and home to leading CNC manufacturers

While APAC, particularly China, leads in volume and overall manufacturing growth, North America and Europe are key hubs for high-end technological innovation and application in specific advanced sectors (aerospace, medical, Industry 4.0). This suggests a global CNC market with differentiated regional strengths and demands. APAC/China offers scale, rapid growth, and is influenced by government policies like Made in China 2025. North America is characterized by “advanced technology adoption,” “innovation,” and strength in aerospace/defense. Europe is known for its “strong industrial base,” “Industry 4.0 leadership,” and key players in advanced CNC manufacturing. This implies that regional strategies should be tailored: focusing on volume and localization in APAC, cutting-edge solutions for specialized industries in North America, and Industry 4.0 integrated systems in Europe.

Initiatives like “Made in China 2025” and similar national manufacturing strategies (e.g., “Make in India” ) are not only driving domestic demand but also fostering domestic CNC capabilities and competition. This could lead to shifts in global market share dynamics and potentially intensify price competition in mid-range CNC machines, while also creating opportunities for collaboration or technology transfer in high-end component areas where China still aims for localization (). Made in China 2025 aims to upgrade Chinese industry, including CNC machine tools, and increase domestic content/self-sufficiency. China is already the largest producer and consumer and has explicit goals to increase domestic share in the high-end market. At the same time, reliance on imports for high-end CNC systems and core components is acknowledged. This creates a dual effect: increased competition from rapidly improving Chinese manufacturers, especially in the volume and mid-range segments , but also continued demand for foreign high-end technology and components (though potentially diminishing over time), presenting a window of opportunity for international firms focused on these areas. Furthermore, possibilities exist for partnerships or joint ventures for foreign companies willing to participate in China’s localization drive. This dynamic will significantly shape the competitive landscape for any global CNC player.

VI. Addressing Challenges and Seizing Opportunities

A. Addressing High Initial Investment and Operational Costs

CNC machines, especially multi-axis and high-precision models, are expensive. Entry-level engravers start at $5,000, laser cutters can exceed $200,000, and high-end 5-axis machines range from $250,000 to $500,000. This is a significant barrier for SMEs. Maintenance and operational costs add to the burden. Solutions include: leasing models (e.g., Tezmaksan’s case ), focusing on ROI through efficiency gains , utilizing tax incentives , and the used equipment market. Cost is a major adoption hurdle, making strategies aimed at lowering this barrier (financing, leasing, clear ROI demonstration) crucial for market expansion.

B. Bridging the Skills Gap: Training and Workforce Development

The industry faces a shortage of skilled operators, programmers, and technicians capable of operating, programming, and maintaining CNC systems. Over 40% of EU employers struggle to find trained CNC operators. Solutions include: upskilling/reskilling programs (e.g., Siemens SITecSkills Academy , Amazon ), apprenticeships , partnerships with technical schools/colleges , user-friendly software (e.g., ROBOCAM+ ), and AI assistants. Government initiatives and industry programs also support training. Companies like Phillips Corporation offer comprehensive training , and Lincoln Tech provides programs with Haas. State-of-the-art machines are ineffective without skilled personnel; addressing this gap is vital for industry growth and for individual companies to leverage their CNC investments fully.

C. Supply Chain Resilience and Diversification

Frequent supply chain disruptions highlight the need for more resilient supply chains. Rising costs for raw materials, transportation, and labor are ongoing challenges. Strategies include: diversifying the supplier base, nearshoring/reshoring , real-time tracking, automated inventory management, using IoT for tracking and maintenance , and enhancing communication with suppliers. US Manufacturing Technology Orders (USMTO) data shows order fluctuations but sustained demand heading into 2025, albeit with longer quote-to-order times. Stable supply chains, both for CNC machine components and for the raw materials used by CNC end-users, are critical for uninterrupted production and cost control.

D. Emerging Opportunities

- Customized and Personalized Products: Growing demand for unique, customized products in sectors like furniture, automotive, and consumer electronics. CNC technology provides the flexibility for this

- Micromachining: Increasing need for micromachining tools for small, intricate components in electronics, aerospace, and medical industries.

- Aftermarket Services: Growing demand for remote diagnostics, real-time monitoring, predictive maintenance, software upgrades, and replacement parts

- Online CNC Machining Services: This market was valued at $1.64 billion in 2024 and is projected to reach $3.29 billion by 2033, with a CAGR of 10.1%. These represent new growth avenues beyond traditional machine sales, often with higher profit margins.

The challenges of high cost and the skills gap are interconnected and can be partially addressed by technological advancements. For example, more user-friendly software , AI assistants , and automation can reduce the training burden and skill requirements for certain operations, while simultaneously improving efficiency to justify the cost. High cost is a barrier , and skilled labor is scarce and expensive. AI and automation can boost productivity with fewer highly skilled operators. Simplified programming software (like ROBOCAM+ in ) lowers the skill threshold. Predictive maintenance via AI/IoT can reduce operational costs and reliance on advanced maintenance technicians for routine diagnostics. Therefore, investing in these “smarter” technologies can simultaneously improve ROI (addressing cost) and make machines operable by a broader talent pool (addressing the skills gap).

The push for supply chain resilience and trends like nearshoring/reshoring could create localized demand surges for CNC machines and services in regions aiming to bolster domestic manufacturing. This presents a direct opportunity for CNC suppliers positioned to respond quickly to these regional expansions of manufacturing capacity. Global supply chains have proven vulnerable. Companies are actively building resilience through diversification, nearshoring, and reshoring. Moving production back home or diversifying manufacturing locations means setting up new or expanding existing facilities, which will require new manufacturing equipment, including CNC machines. CNC suppliers with strong presence or distribution networks in regions experiencing this reshoring/nearshoring trend (e.g., North America ; potentially Europe) can capitalize on this growing demand for local manufacturing capabilities. This also ties into government incentives for domestic production.

VII. Competitive Landscape and Key Player Strategies

A. Overview of Global Key Players

The market is described as highly consolidated in some reports and more fragmented in others. In the broader machine tool market, the top five companies (Amada, DMG Mori, Makino, JTEKT, Okuma America) hold a 12-15% share. Key players include: Amada Co. Ltd , ANCA Pty Ltd. , DMG MORI Co. Ltd. , FANUC Corp. , Haas Automation Inc. , Hurco Companies Inc. , JTEKT Machinery/Corporation , Makino Inc. , Mazak Corporation (Yamazaki Mazak) , Okuma Corporation , Siemens AG , Schuler AG , Trumpf , GF Machining Solutions AG , Mitsubishi Electric , Brother Industries , Doosan Machine Tools. Chinese players: KEDE Numerical Control, Haitian Precision, Genesis, etc., are catching up technologically. Huazhong Numerical Control provides domestic CNC systems. Dalian Machine Tool Group Corporation Ltd. Understanding the main competitors and their market positioning is crucial for strategic planning.

B. Noteworthy Strategic Initiatives

Leading companies generally focus on increasing product penetration through cross-marketing, product line extensions, and technologically advanced solutions. Strategic partnerships are used to leverage complementary expertise, expand market reach, and drive innovation, such as Mitsubishi Electric India’s collaboration. M&A activity is also significant, like DMG MORI’s acquisition of KURAKI in September 2023 to expand its horizontal boring and milling capabilities and integrate digitalization and automation. In new product launches, Okuma introduced the OSP-P500 CNC control system with a dual-core processor and digital twin technology in August 2023. DMG Mori released five new production platforms under its “Machining Transformation (MX)” strategy in January 2025. Tormach launched the 1500MX mill in April 2024 , and Bambu Lab introduced the H2D in March 2025. GF Machining Solutions’ “Strategy 2025” focuses on strengthening core segments, enhancing profitability, and customer experience through innovative solutions. Looking towards 2025, the strategies of major manufacturers (e.g., Haas, Mazak, DMG Mori, Okuma, Fanuc) generally emphasize innovation, advanced technology, R&D investment, hybrid manufacturing, automation, energy efficiency, user-friendly control systems, and strong support and service networks. These initiatives indicate that competition is shifting towards more integrated, intelligent, and comprehensive manufacturing solutions, often achieved through strategic alliances or acquisitions.

The competitive landscape shows leading players engaged in a dual race: technological competition on high-end features (AI, multi-axis, hybrid, digital twin) and strategic consolidation/collaboration to expand market access and solution completeness. Companies like DMG MORI and Okuma are launching highly advanced systems with digital twin tech and new control platforms, showing the tech race intensity. Simultaneously, DMG MORI’s acquisition of KURAKI and Mitsubishi’s collaboration show moves to consolidate expertise or expand reach. The top players listed in are all known for significant R&D and broad portfolios. This dual strategy raises the barriers to entry and sustained competition. It implies smaller players will find it increasingly difficult to compete across the board and may need to find niche specializations or collaborate.

The strategies of major CNC manufacturers (e.g., as noted in : Haas focusing on affordability/reliability; Mazak on innovation/advanced tech; DMG Mori on hybrid solutions/automation; Okuma on high precision/energy efficiency; Fanuc on automation/robotics) reflect the importance of differentiated competition in a mature market. They are not all pursuing the exact same value proposition but carving out distinct strengths. This creates opportunities for other companies to compete by identifying unmet combinations of price, performance, and features, or by innovating beyond them in specific dimensions. If all major players pursued identical strategies, the market would be highly commoditized. Their varied approaches suggest a more complex competitive dynamic. This means there isn’t a single “best” strategy. For users (potentially smaller CNC shops or large end-users choosing suppliers), it means they can select suppliers whose strategies best align with their priorities. For competitors, it means they can find gaps in the market. For example, if most focus on the high end, there might be opportunities in robust mid-range machines with excellent service, or in highly specialized but less complex machines.

VIII. Strategic Business Development Directions for 2025 (“Focus Areas”)

Based on the in-depth analysis of the CNC industry in 2025, the following strategic directions aim to provide clear development priorities for your company to achieve sustained growth and success in this dynamic market.

-

Specialize in High-Growth and High-Value Application Areas

- Strategic Focus: Concentrate resources and efforts on industry segments characterized by strong growth, complex demands, and higher added value.

- Aerospace & Defense: Capitalize on the sector’s persistent need for high precision, complex geometry machining, and advanced material handling. Develop expertise in 5-axis machining and quality assurance for critical components.

- Medical Device Manufacturing: Address the demand for high-precision, often miniaturized components made from specialized or biocompatible materials. Explore the potential of micromachining technologies.

- New Energy Vehicle (EV) Components: As the automotive industry transforms, focus on supplying parts for electric vehicles, which often require high precision and new material considerations.

- Precision Engineering Niches: Target applications with extreme requirements for accuracy and complex designs, potentially spanning multiple industries.

- Aerospace & Defense: Capitalize on the sector’s persistent need for high precision, complex geometry machining, and advanced material handling. Develop expertise in 5-axis machining and quality assurance for critical components.

- Strategic Value: These segments are consistently identified as key drivers of CNC demand and are often less price-sensitive for solutions meeting their stringent requirements. Specialization builds deeper expertise and a stronger value proposition.

- Strategic Focus: Concentrate resources and efforts on industry segments characterized by strong growth, complex demands, and higher added value.

-

Embrace and Integrate Key Technological Advancements

- Strategic Focus: Actively invest in and apply cutting-edge technologies that enhance efficiency, capability, and competitiveness.

- Invest in AI & Machine Learning: Implement AI-driven toolpath optimization, predictive maintenance services, and quality control to boost efficiency and reduce operational costs.

- Adopt/Offer Multi-Axis Machining Capabilities: Develop or acquire 5-axis (or higher) machining capabilities to handle complex parts and reduce setups, especially if targeting aerospace or medical markets.

- Integrate Automation & Robotics: Offer solutions incorporating robotics for material handling, inspection, or even fully “lights-out” manufacturing cells to address labor shortages and increase productivity.

- Leverage IoT & Connectivity: Develop or utilize CNC machines with robust IoT capabilities for real-time monitoring, data analytics, and remote diagnostics, offering this as a value-added service.

- Explore Hybrid Manufacturing: If relevant to target markets, investigate combining additive manufacturing with CNC machining for innovative part production and prototyping.

- Invest in AI & Machine Learning: Implement AI-driven toolpath optimization, predictive maintenance services, and quality control to boost efficiency and reduce operational costs.

- Strategic Value: Technology is a primary differentiator. Early and effective adoption of these trends is crucial for staying competitive, improving efficiency, and meeting evolving customer needs.

- Strategic Focus: Actively invest in and apply cutting-edge technologies that enhance efficiency, capability, and competitiveness.

-

Focus on Value-Added Services and Solutions, Not Just Hardware Sales

- Strategic Focus: Transition from a traditional equipment seller to an integrated solutions provider.

- Customization Services: Offer tailored machine configurations or machining services for unique customer requirements.

- Rapid Prototyping: Leverage CNC capabilities, potentially combined with hybrid AM, to offer fast turnaround services for prototypes.

- Integrated Solutions: Move beyond selling standalone machines to offering comprehensive packages including software, automation, training, and ongoing support (aligning with Industry 4.0 ).

- Predictive Maintenance & Aftermarket Support: Utilize IoT and AI to offer predictive maintenance contracts, spare parts, and upgrade services, creating recurring revenue streams.

- Consulting & Process Optimization: Leverage internal CNC expertise to help customers optimize their manufacturing processes.

- Customization Services: Offer tailored machine configurations or machining services for unique customer requirements.

- Strategic Value: Services often yield higher margins, build stickier customer relationships, and differentiate from competitors focused solely on price or hardware. The growth of the online CNC machining services market underscores this trend.

- Strategic Focus: Transition from a traditional equipment seller to an integrated solutions provider.

-

Cultivate a Highly Skilled Workforce and Foster an Innovation Culture

- Strategic Focus: Treat talent and innovation as core competencies.

- Invest in Training: Implement robust internal training programs and/or partner with vocational schools and universities to build a pipeline of skilled CNC programmers, operators, and maintenance technicians.

- Embrace User-Friendly Technology: Adopt CNC systems with intuitive interfaces and programming tools to lower the learning curve and broaden the potential talent pool.

- Continuous Learning: Foster an environment that encourages employees to learn new technologies and processes.

- Focus on R&D: If a machine builder, invest resources in R&D in key technology areas (AI, multi-axis, etc.); if a user, partner with innovative suppliers.

- Invest in Training: Implement robust internal training programs and/or partner with vocational schools and universities to build a pipeline of skilled CNC programmers, operators, and maintenance technicians.

- Strategic Value: A skilled workforce is essential to effectively utilize advanced CNC technology. Innovation is fundamental to staying ahead. This directly addresses the skills gap challenge.

The automatic robotic arm gripping the motorbike engine parts. The hi-technology material handling process by robotic system in automotive assembly factory.

- Strategic Focus: Treat talent and innovation as core competencies.

-

Strategic Regional Focus and Supply Chain Optimization

- Strategic Focus: Develop market strategies tailored to regional characteristics and ensure supply chain robustness.

- Targeted Regional Strategies: Adapt strategies based on regional strengths: e.g., high-volume, cost-sensitive production for certain APAC markets (leveraging China’s manufacturing ecosystem ); advanced technology solutions for North America/Europe.

- Localization (if operating in/targeting China): Understand and adapt to China’s “Made in China 2025” goals, potentially partnering locally or sourcing components where quality meets standards, while protecting core high-end IP.

- Build Supply Chain Resilience: Diversify suppliers for critical components, explore regional sourcing options to mitigate geopolitical and logistical risks, and improve inventory management through better visibility and forecasting.

- Consider Niche Markets in Emerging Economies: Beyond China/India, explore other industrializing nations in APAC or other regions where CNC adoption is growing ( mentions Brazil).

- Targeted Regional Strategies: Adapt strategies based on regional strengths: e.g., high-volume, cost-sensitive production for certain APAC markets (leveraging China’s manufacturing ecosystem ); advanced technology solutions for North America/Europe.

- Strategic Value: The global market requires nuanced regional strategies. Supply chain stability is critical for consistent delivery and cost control.

- Strategic Focus: Develop market strategies tailored to regional characteristics and ensure supply chain robustness.

These strategic directions are not mutually exclusive. The most effective “focus areas” will likely involve a combination of these recommendations, tailored to the company’s specific strengths, resources, and target markets. For example, specializing in medical devices (Direction 1) inherently requires embracing advanced multi-axis and micromachining technologies (Direction 2) and offering robust quality assurance and customization services (Direction 3). Market trends are interconnected (e.g., advanced industries require advanced tech). A singular strategy (e.g., focusing only on cost-cutting without technological upgrades) is unlikely to succeed long-term given the market dynamics. Therefore, companies need to view these recommendations as building blocks for a comprehensive strategy, rather than simply choosing one.

The underlying theme across all successful strategic directions is Adaptability and Value Creation. The CNC market is dynamic, with constantly evolving technologies and customer demands. Companies that can adapt quickly, innovate continuously, and clearly demonstrate the value they create (whether through higher precision, greater efficiency, specialized solutions, or comprehensive support) will thrive. This means shifting from a purely transactional model towards one based on partnership and problem-solving. The report details numerous evolving trends: AI, IoT, hybrid AM, new materials, sustainability demands, skills gaps, supply chain issues. These present both challenges and opportunities. A static strategy will quickly become obsolete. Recommendations like embracing new tech (Direction 2), focusing on value-added services (Direction 3), and cultivating a skilled workforce (Direction 4) are all aimed at building adaptability. The most successful companies will be those that not only react but proactively anticipate market shifts and position themselves to deliver superior value in a changing landscape. It’s a mindset shift from merely “selling machines” to “providing manufacturing solutions.”

IX. Conclusion: Positioning for Future Success

The CNC industry in 2025 presents significant dynamism and immense opportunity. The wave of automation, the relentless pursuit of precision machining, the deepening of Industry 4.0, and strong demand from key downstream sectors (like automotive, aerospace, medical) form a solid foundation for continued industry growth. Concurrently, rapid advancements in technologies such as AI, multi-axis machining, IoT, and hybrid manufacturing are reshaping the capabilities and application scenarios of CNC technology.

However, the industry also faces challenges, including high initial investment costs, shortages of skilled talent, and global supply chain volatility. Successfully navigating this complex landscape requires companies to look beyond the hardware itself and focus on delivering integrated solutions that combine advanced technology, software, and services.

To achieve success in 2025 and beyond, companies must possess strategic agility, actively embrace technological change, and consistently create value with a customer-centric approach. This entails:

- Deepening Specialization: Building strong expertise and competitive moats in high-growth, high-value segments like aerospace, medical, and new energy vehicles.

- Leading Technological Innovation: Decisively investing in and integrating key technologies like AI, multi-axis machining, automation, and IoT, transforming them into competitive advantages.

- Expanding the Value Chain: Extending from equipment sales to offering value-added services such as customization, rapid prototyping, and predictive maintenance, thereby building stronger customer relationships and revenue streams.

- Strengthening the Talent Base: Addressing the skills gap through training and partnerships, cultivating innovative teams capable of mastering advanced technologies.

- Optimizing Global Footprint: Developing differentiated strategies based on regional market characteristics and committing to building more resilient global supply chains.

The future belongs to CNC companies that dare to innovate, adapt quickly, and deeply understand the evolving needs of manufacturing. Through forward-looking strategic planning and decisive execution, businesses can distinguish themselves in this era of opportunity, achieving sustainable growth and industry leadership.